Is HDFC Life Sanchay Plus safe?

While there are many opportunities that come with respective benefits, the assurance and convenience that a life insurance plan with guaranteed benefit offers is irreplaceable. “HDFC Life Sanchay Plus” is a non-participating, non-linked, savings insurance plan that offers guaranteed returns for you and your family.

Is HDFC Life Sanchay Par Advantage good or bad?

This investment option offers you both financial protection and wealth creation. HDFC Sanchay Par Advantage Plan provides guaranteed benefits along with the potential for bonuses, ensuring financial security and growth. Why we need your mobile number? Your money will stay invested for 20 years.

How is HDFC Life Sanchay policy?

HDFC Life Sanchay plans assure you of a guaranteed1 income. If the policyholder dies within the policy term, the nominee gets the pre-defined sum assured with accrued bonuses (if any) as the death benefit which is designed to support the bereaved family financially.

Which is better, PPF or HDFC Sanchay Plus?

However, for the moment, PPF offers a much higher return than what HDFC Life Sanchay has to offer. Therefore, there is a clear margin that you have. PPF interest is exempt from tax. And PPF is way more flexible than this HDFC life product.

Can I cancel HDFC Life Sanchay Plus after 1 year?

Yes, you can cancel an HDFC Life Sanchay Plus policy after one year, subject to the terms and conditions outlined in the policy document. However, it’s important to review the specific terms of your policy to understand any surrender charges or penalties that may apply upon cancellation.

Which is better HDFC Life or HDFC Ergo?

HDFC Standard Life Insurance scored higher in 2 areas: CEO approval and Positive Business Outlook. HDFC ERGO General Insurance company scored higher in 4 areas: Diversity and inclusion, Work-life balance, Senior management and Recommend to a friend.

Can I surrender my HDFC life Sanchay par advantage?

Surrender Benefit– The HDFC Life Sanchay Par Advantage Plan offers a surrender benefit option. Regardless of the policy’s payment term, this insurance plan can only be relinquished once the first two years premiums have been paid in full.

Which is better, Sanchay Par or Sanchay Plus?

HDFC Life Sanchay Par Advantage Plan vs HDFC Life Sanchay Plus. “Sanchay Par” gives Guaranteed Income during the income term that increases every year whereas “Sanchay Plus” is for Steady retirement income with Life Long Income Option. Please read our review of HDFC Life Sanchay Plus.

Is it worth investing in HDFC?

There are 20 analysts who have given it a strong buy rating & 17 analysts have given it a buy rating.

Why did HDFC Life fall?

HDFC Life Insurance shares fell 4 percent on April 19 as the market reacted negatively to the drop in the its Value of New Business (VNB) margin, forcing brokerages to cut the target price even as they largely stuck to their “buy” calls on the stock. At 10.26 am, the stock was trading over a percent lower at Rs 600.

Can I break my HDFC Life policy?

Yes, you can surrender your policy once the waiting period is completed. It depends on the type of your policy and its waiting period time frame.

Why HDFC Life is better than other companies?

It Offers Comprehensive Coverage: HDFC Life Term Insurance offers comprehensive coverage for death, terminal illness and critical illness. This makes it a better choice than other plans that only cover death. 2. It Has Low Premiums: HDFC Life Term Insurance has some of the lowest premiums in the market.

What is HDFC Life Sanchay fixed maturity plan?

A non-linked, non-participating individual savings plan called the HDFC Life Sanchay Fixed Maturity Plan is created to offer assured returns in the form of a lump sum payment. The plan gives participants the freedom to select among single-pay, limited-pay, or monthly payment choices.

What is HDFC Life Sanchay Par Advantage?

To help you achieve your goals, we present to you “HDFC Life Sanchay Par Advantage”, a life insurance solution which allows you to live an uncompromised life, whilst securing the future of your family and, ensuring you leave behind a legacy for them.

What is the maturity benefit of Sanchay plus?

Maturity Benefit: The maturity benefit is equal to Guaranteed Sum Assured on Maturity plus accrued Guaranteed Additions Where, Guaranteed Sum Assured on Maturity is equal to Total Annualized Premiums payable under the policy during the premium payment term.

Can I withdraw money from HDFC Life?

The Policyholder has the option of making partial withdrawals subject to the following conditions: Partial withdrawals shall not be allowed within first five policy years. The Life Assured is at least 18 years of age. The fund value after withdrawal should not fall below 150% of annualized premium.

What is the grace period for HDFC Sanchay Plus?

The grace period under this policy is of 15 days for the monthly frequency of premium payment and 30 days for other frequencies.

How much money will I get if I surrender my HDFC life policy?

As well, policy surrender is typically allowed after 3 years of premium payments under the guaranteed surrender value. Surrendering after this period may result in a surrender value of approximately 30% of the premiums paid so far.

Is HDFC Life profitable?

HDFC Life Q4 Results:The private sector insurer posted a net profit of ₹411 crore, a rise of 14.8% from ₹358 crore in the year-ago period.

Should I buy HDFC for long term?

If you are a long term trader then start SIP on HDFC Bank. HDFC Bank is a good stock for long terms. Every dip will be a buy opportunity for this stock.

How can I get refund from HDFC Life?

To apply for a refund, you’ll need to submit a written request to HDFC Life, along with your policy documents and proof of premium payment. You can do this either through the mail or online. Once your refund request is received, HDFC Life will process it and issue a refund check within 30 days.

How much money will I get if I surrender my policy?

How much money will I get if I surrender my LIC policy? In case you surrender your LIC after 3 years, your surrender value will be approximately 30% of the total premiums paid. However, the premium paid for the first year and the premiums paid towards accidental benefits coverage riders are excluded from it.

Is HDFC Sanchay Par a good plan?

The HDFC Life Sanchay Par Advantage plan gives you features and benefits that are difficult to refuse and you can guarantee the financial safety of your family at the same time. If you want to be sure of a plan which have you covered in terms of financial freedom for your family, this is the right plan for you.

What is HDFC Life Sanchay?

HDFC SL Sanchay Plan is a traditional Endowment Plan with Guaranteed Benefits thereby enhancing savings and also providing life insurance coverage. Best Investment Plans. Save Upto ₹46,800 in tax under Sec 80C. Inbuilt Life Cover. Tax Free Returns Unlike FD+

What is the rating of HDFC Life?

Good. 4.4 / 5(Based on 36 Reviews)

Is my money safe in HDFC?

In India, HDFC Bank has continuously been ranked among the best banks in terms of both assets and client happiness. The Reserve Bank of India (RBI) controls the bank, ensuring that it follows strict financial laws and security procedures.

Why did HDFC Life Insurance fall?

HDFC Life Insurance shares fell 4 percent on April 19 as the market reacted negatively to the drop in the its Value of New Business (VNB) margin, forcing brokerages to cut the target price even as they largely stuck to their “buy” calls on the stock.

What is the maturity benefit of Sanchay plus?

Maturity Benefit: The maturity benefit is equal to Guaranteed Sum Assured on Maturity plus accrued Guaranteed Additions Where, Guaranteed Sum Assured on Maturity is equal to Total Annualized Premiums payable under the policy during the premium payment term.

Is it safe to invest in HDFC Balanced Advantage fund?

HDFC Balanced Advantage is among the best in the category and has a 30-year track record of delivering consistently above-average returns over the long term. Investors can consider lump-sum investments in the fund for the medium to long term.

What is HDFC Life Sanchay plus?

What is HDFC Life Sanchay par advantage?

What is HDFC Life Sanchay fixed maturity plan?

Is HDFC Sanchay plus ULIP?

You’re thinking about HDFC Life Sanchay, and you’re wondering if it’s a good investment. That’s a smart move! It’s important to do your research before committing to any financial product.

Let’s break down HDFC Life Sanchay and see if it’s a good fit for you.

What is HDFC Life Sanchay?

HDFC Life Sanchay is a non-participatingendowment plan. In simple terms, it’s a life insurance policy that provides life cover and guaranteed maturity benefits.

Here’s the gist:

Life Cover: If something happens to you during the policy term, your family receives a death benefit.

Guaranteed Maturity Benefit: When the policy matures, you get a guaranteed lump sum. This amount is fixed and not affected by market fluctuations.

The Good Stuff:

Guaranteed Returns: HDFC Life Sanchay offers guaranteed returns, meaning you know exactly how much you’ll get at maturity. This can be comforting for those who prefer certainty.

Flexibility: You have the option to choose the policy term and the premium payment term, giving you some control over your investment.

Life Cover: It provides financial security for your loved ones in case of your unfortunate demise.

The Not-So-Good Stuff:

Lower Returns: Guaranteed returns often mean lower returns compared to market-linked products. This is because the insurance company needs to factor in the guaranteed payout and its own expenses.

Limited Flexibility: The guaranteed nature of the policy means you can’t take advantage of market opportunities.

High Premiums: Compared to other plans, the premiums for HDFC Life Sanchay can be higher due to the guaranteed benefits.

Who is HDFC Life Sanchay Suitable For?

Risk-averse individuals: If you prefer certainty and don’t want to be exposed to market fluctuations, HDFC Life Sanchay can be a good option.

Individuals seeking a guaranteed return: If your primary goal is to get a guaranteed lump sum at maturity, HDFC Life Sanchay can provide that.

Individuals looking for life cover: It provides a safety net for your loved ones in case of your untimely death.

Who Might Want to Consider Alternatives?

Individuals seeking higher returns: If you’re willing to take on more risk in hopes of earning higher returns, market-linked investments might be a better choice.

Individuals with a higher risk appetite: If you’re comfortable with market fluctuations, other investment options might be more suitable.

Key Features of HDFC Life Sanchay:

Policy Term: You can choose a policy term of 10, 15, 20, or 25 years.

Premium Payment Term: You can pay premiums for the entire policy term or for a shorter period.

Minimum Premium: There’s a minimum premium amount required, which varies based on the policy term and your age.

Death Benefit: If you pass away during the policy term, your family receives a death benefit.

Maturity Benefit: At maturity, you receive a guaranteed lump sum.

Comparing HDFC Life Sanchay to Other Endowment Plans

HDFC Life Sanchay isn’t the only endowment plan on the market. Several other insurers offer similar products with variations in features and benefits.

Before making a decision, it’s crucial to compare different plans based on factors like:

Premium amount

Guaranteed returns

Death benefit

Policy term

Riders available

The financial strength and reputation of the insurer

FAQs:

1. How much can I expect to receive at maturity?

The maturity benefit is a guaranteed amount based on the premium you pay and the policy term. You can get a personalized quote from HDFC Life to estimate your maturity benefit.

2. Can I withdraw funds before maturity?

No, HDFC Life Sanchay doesn’t allow withdrawals before maturity.

3. Are there any riders available?

Yes, HDFC Life Sanchay offers various riders, such as accidental death benefit, critical illness cover, and disability benefit. Riders provide additional coverage and protection, but they come at an extra cost.

4. What if I miss a premium payment?

If you miss a premium payment, your policy may lapse. However, HDFC Life offers a grace period to make the payment without losing your policy. If the premium isn’t paid within the grace period, your policy may lapse, and you’ll lose the benefits.

5. How do I claim the maturity benefit?

Once the policy matures, you’ll need to submit a claim form to HDFC Life along with the necessary documents.

6. Is HDFC Life Sanchay a good investment?

The answer depends on your individual financial goals and risk tolerance. If you prioritize guaranteed returns and security, HDFC Life Sanchay can be a good option. However, if you’re looking for higher returns, other investment options might be more suitable.

It’s essential to understand your needs, evaluate your options carefully, and consult with a financial advisor before making a decision.

See more here: Is Hdfc Life Sanchay Par Advantage Good Or Bad? | Hdfc Life Sanchay Good Or Bad

A Genuine Review on HDFC Life Sanchay Plus – Holistic

Is HDFC Life Sanchay Plus good or bad? Let us review by diving into a deeper analysis of HDFC Life Sanchay Plus to validate if it is a pro or a con. HDFC Life Sanchay Plus: Holistic Investment

An honest review of HDFC Life Sanchay Par Advantage – Holistic

Should you look to invest in HDFC Life Sanchay Par Advantage Plan for your Financial Goals? Is HDFC Life Sanchay Par Advantage Plan a good or bad Holistic Investment

HDFC Life Sanchay Plus Review: The good and the bad

HDFC Life Sanchay Plus Review: The good and the bad. HDFC Life Sanchay Plus is a non-participating traditional life insurance plan. That means the payouts are guaranteed. There is no market risk CNBCTV18

HDFC Life Sanchay Par Advantage Plan [Review]: Should You

Chapters:00:00 Introduction00:09 Key Features00:26 Eligibility Explained01:13 Illustration of Immediate Income Option 02:42 Average Rate of Return03:33 Defer… YouTube

HDFC Life Sanchay Plus Plan – Review, Benefits

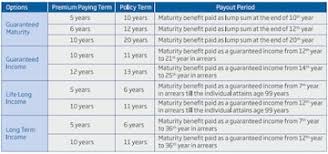

The 4 plan options are as follows: Guaranteed Maturity – Maturity amount paid as lumpsum at the end of the policy term. Guaranteed income – Maturity benefit MyInsuranceClub

Features and Benefits of HDFC Life Sanchay Plus

Table of Content. 1. Introduction. 2. Why and who must buy? 3. Features of HDFC Life Sanchay Plus. 4. Benefits of HDFC Life Sanchay Plus. 5. Secure Your Future with HDFC Life Sanchay Plus. HDFC Life Insurance

HDFC Life Sanchay Plus Plan: Your Guide to Guaranteed

1. HDFC Life Sanchay Plus: An Overview. 2. HDFC Life Sanchay Plus: Plan Options. 3. 5+ Reasons to Choose the HDFC Life Sanchay Plus Plan. 4. Wrapping It HDFC Life Insurance

Insurance Review: HDFC Life Sanchay Plus: Features, options

HDFC Life Sanchay Plus is a traditional life insurance plan with guaranteed additions in place of bonus. Let us see, whom it suits? The Financial Express

How safe is HDFC Life’s Sanchay Plus? – The Hindu

While most guaranteed products from insurers give 4.5-5.5 per cent return, HDFC Life’s recently-launched Sanchay Plus promises 6.3 per cent return under two of its plans. The Hindu BusinessLine

See more new information: pilgrimjournalist.com

Hdfc Life Sanchay Fixed Maturity Plan-Review : Is It Good Or Bad?

Hdfc Sanchay Plus Special Honest Review – With Returns Calculation | Every Paisa Matters

Hdfc Life Sanchay Par Advantage Plan – Details Hdfc Sanchay Par Advantage – [Honest Review – Hindi]

Reality Of Money Back Plans, Guaranteed Income, Endowment | Insurance + Investment? | Lla

Sanchay Plus From Hdfc Life: Is It A Good Plan To Invest? Part 1

Link to this article: hdfc life sanchay good or bad.

See more articles in the same category here: https://pilgrimjournalist.com/wiki/